Quarterly Report For The Financial Period Ended 30 September 2025

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

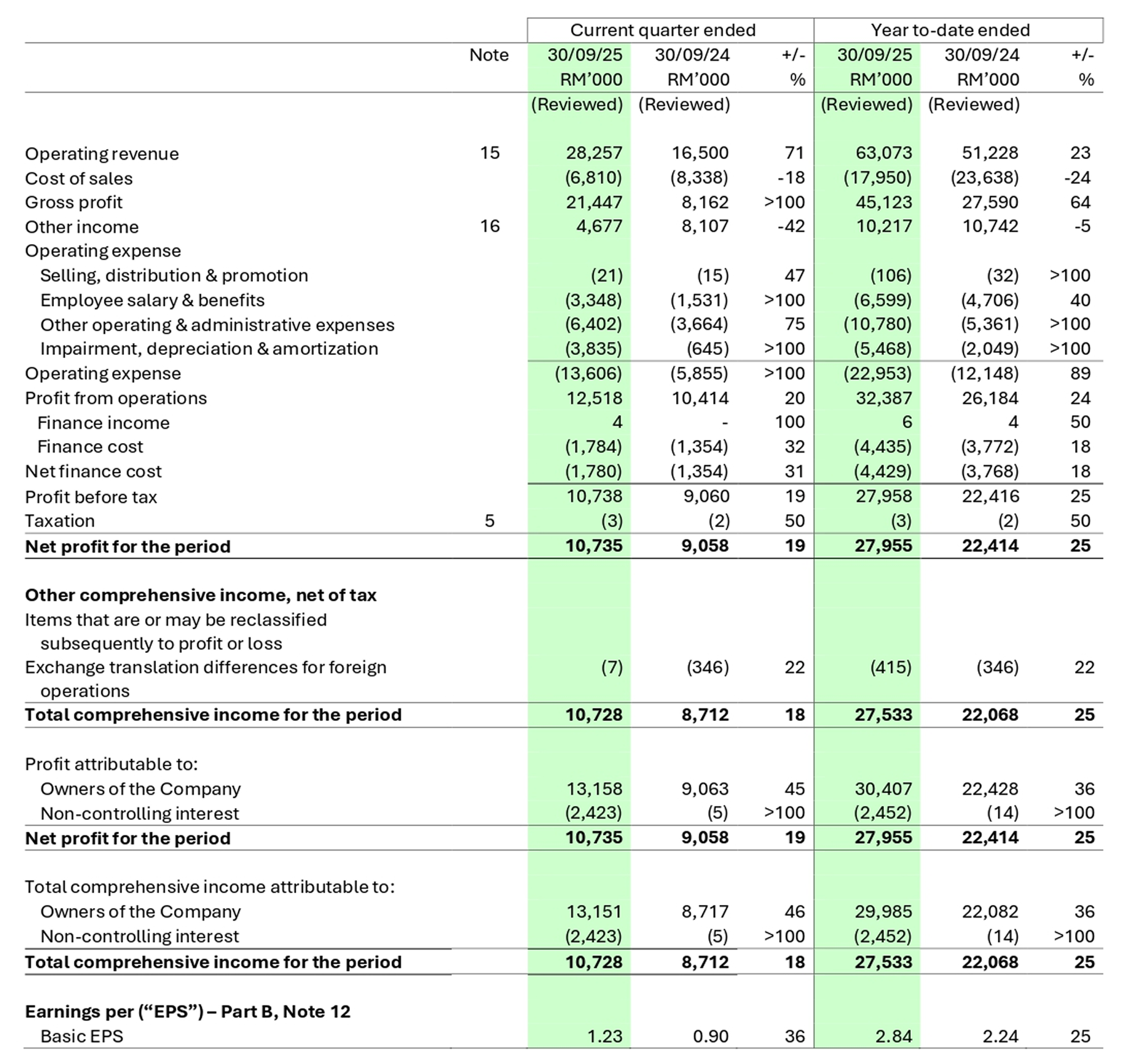

Unaudited Condensed Consolidated Statements Of Profit Or Loss and Comprehensive Income For The Current Quarter And

Year-To-Date ("YTD")

Ended 30 September 2025

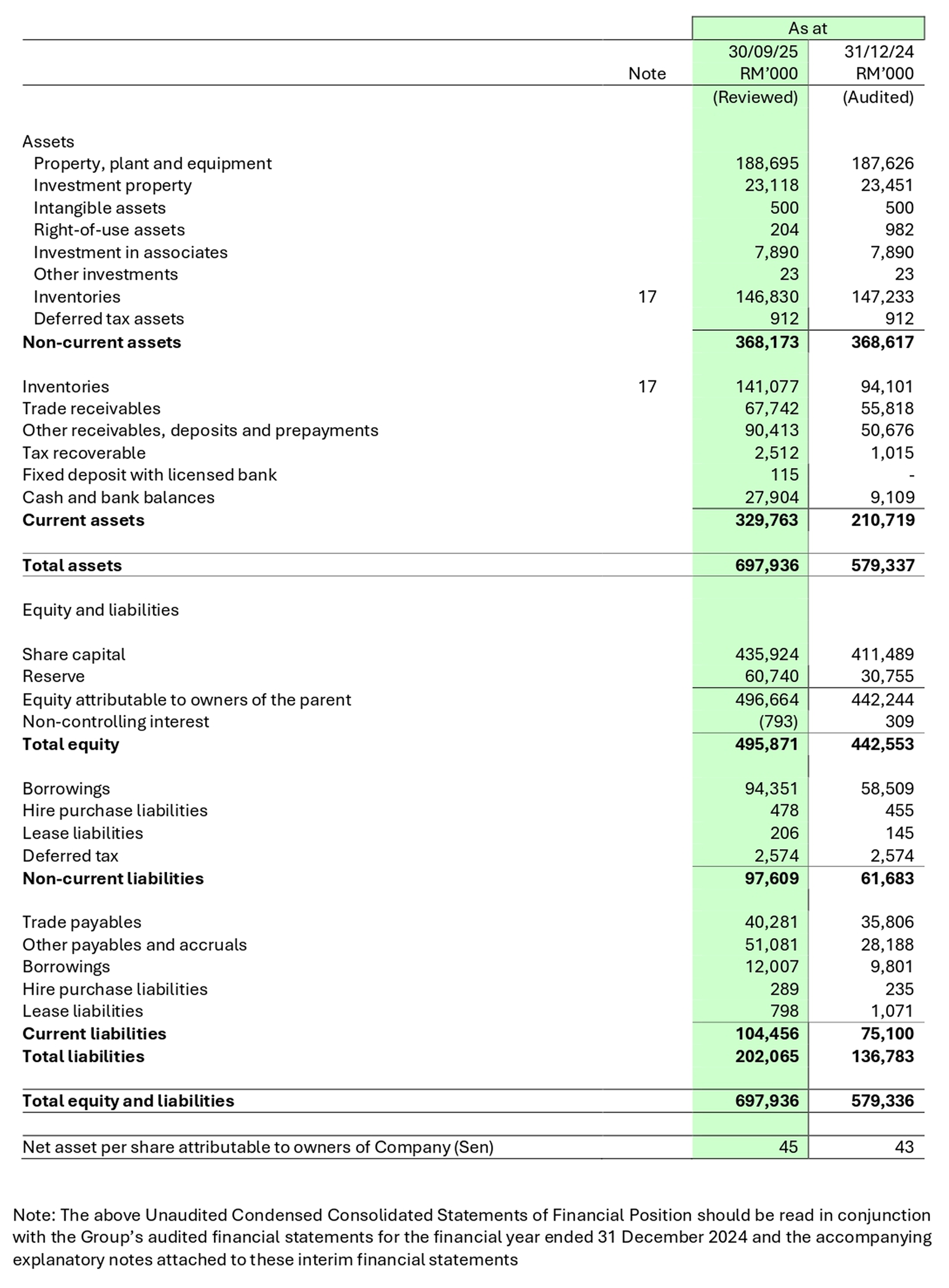

Unaudited Condensed Consolidated Statements of Financial Position

As at 30 September 2025

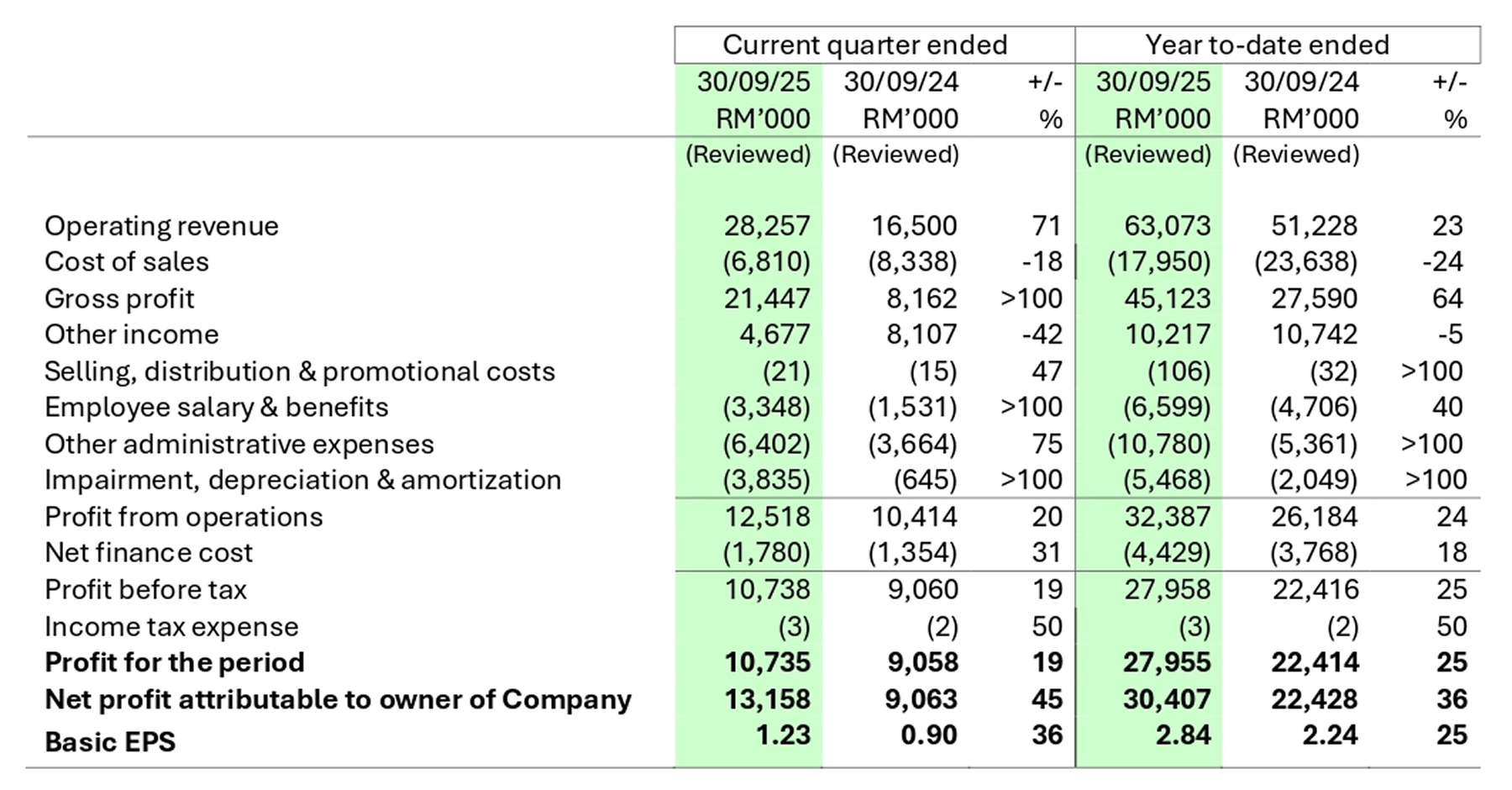

Group's Financial Performance Review

CURRENT QUARTER FINANCIAL PERFORMANCE

For the third quarter ended 30 September 2025 ("Q3 2025"), the Group recorded a profit after tax attributable to owners of the Company (PATAMI) of RM13.16 million, an increase of 45% from RM9.06 million in Q3 2024.

Operating revenue for Q3 2025 increased to RM28.26 million (Q3 2024: RM16.50 million), mainly supported by stronger sales of liquid fertiliser products. The improvement was driven by higher output from the Group's bioconversion activities, whereby effluent generated from the Pulp & Paper segment is utilised by the Fertiliser segment as raw material and further processed into value-added liquid fertiliser (NexBooster) for commercial sale. Demand remained firm from both existing and new customers as production continued to scale.

The Printing & Publishing segment contributed RM0.90 million (Q3 2024: RM1.30 million), consistent with the timing of government-related printing projects during the quarter.

Profitability

Profit from operations stood at RM12.52 million, compared to RM10.41 million in Q3 2024. Net finance cost increased

to RM1.78 million (Q3 2024: RM1.35 million), reflecting additional financing to support business expansion.

Profit before tax increased to RM10.74 million (Q3 2024: RM9.06 million). After accounting for income tax expenses of RM0.03 million (Q3 2024: RM0.02 million), profit for the period amounted to RM10.74 million.

Accordingly, the Group achieved a PATAMI of RM13.16 million, compared to RM9.06 million in the same quarter last year. The Group continues to benefit from available tax incentives and the utilisation of accumulated tax allowances.

YEAR TO DATE FINANCIAL PERFORMANCE

For the nine-month period ended 30 September 2025 ("YTD 2025"), the Group achieved a profit after tax attributable to owners of the Company (PATAMI) of RM28.47 million, compared to RM22.10 million in the corresponding period of 2024 ("YTD 2024"). The improvement reflects stronger contributions from the Fertiliser segment and improved gross margins.

For YTD 2025, the Group recorded total revenue of RM76.52 million (YTD 2024: RM54.80 million), representing a 40% increase. The stronger performance was primarily supported by higher sales of liquid fertiliser produced through the Group's bio-conversion process, whereby effluent generated from the Pulp & Paper segment is further converted by the Fertiliser segment into liquid fertiliser (NexBooster) for commercial sale. The increased revenue reflects wider market penetration and growing demand from both recurring and new customers.

The Printing & Publishing segment continued to contribute modestly in line with the delivery cycle of governmentrelated printing assignments.

Revenue and Cost of Sales

Cost of sales stood at RM25.74 million (YTD 2024: RM31.11 million), reflecting improved production efficiency and

increased utilisation of pulp & paper manufacturing effluent as an internal process by-product to support operational

needs.

Gross profit increased significantly to RM50.78 million (YTD 2024: RM23.69 million), demonstrating stronger operating leverage and margin improvements.

Other income amounted to RM12.94 million (YTD 2024: RM13.67 million), primarily arising from the external sales of effluent generated from the Pulp & Paper segment. Effluent sold internally to the Fertiliser segment for bio-conversion activities were eliminated at Group consolidation. The remaining balance of other income consisted of gains on equipment disposals and other recurring income streams such as rental income

Selling and distribution expenses increased to RM0.16 million (YTD 2024: RM0.04 million), in line with expanded promotional and logistics support.

Employee salaries & benefits increased to RM11.61 million (YTD 2024: RM5.50 million), driven mainly by additional staffing to support the pre-operating activities of the newly formed joint venture entity, which is responsible for driving the development of the Group's planned 150,000 MT pulp and paper manufacturing plant.

Other administrative expenses rose to RM18.71 million (YTD 2024: RM10.36 million), reflecting higher corporate overheads, project mobilisation requirements and costs relating to effluent-processing optimisation.

Impairment, depreciation and amortisation expenses amounting to RM10.95 million (YTD 2024: RM2.10 million), mainly attributable to the recognition of Expected Credit Losses ("ECL") of RM3.0 million, coupled with higher depreciation from newly capitalised assets.

Profitability

Profit from operations improved to RM32.14 million (YTD 2024: RM19.07 million), driven by stronger revenue and

improved gross margin performance.

Net finance cost increased to RM5.36 million (YTD 2024: RM3.88 million), consistent with additional financing facilities drawn to support expansion and working capital requirements.

Consequently, profit before tax increased to RM26.78 million (YTD 2024: RM15.19 million). After accounting for tax incentives and utilisation of accumulated allowances, the Group delivered PATAMI of RM28.47 million (YTD 2024: RM22.10 million).

Commentary on Prospects and Targets

The Group remains focused on strengthening its core manufacturing operations and driving long-term value creation through the progressive development of its flagship Green Technology Park ("GTP") in Pekan, Pahang. With projects advancing across pulp and paper, fertiliser, animal feed and biomass, the Group expects sustained revenue and earnings growth over the medium term.

A key milestone was reached on 16 April 2025 with the signing of a Joint Venture Agreement between Nextgreen IOI Pulp Sdn Bhd and Hong Kong Paper Source Co., Limited (a wholly-owned subsidiary of Xiamen C&D Paper & Pulp Group Co., Limited). This led to the incorporation of Neuwhite Paper Pulp Sdn Bhd ("NWPP") on 29 April 2025, which will develop and operate a 150,000-METRIC TON per annum bleached chemical EFB pulp mill under Phase 2A of the GTP. This project positions the Group to emerge as a regional producer of sustainable pulp, strengthening its longterm competitiveness and export potential.

In the fertiliser segment, Nextgreen Fertilizer Sdn Bhd (NGF) is progressing towards completion of its 30,000-METRIC TON solid fertiliser facility, with CCC approvals underway. Trial production has commenced, with products delivered for evaluation in Uzbekistan, Libya, and durian plantations in Raub. An automated production line is scheduled for commissioning in Q1 2026, which will increase NGF's total combined production capacity to 60,000 METRIC TON annually and position the Group to scale its market presence locally and internationally.

In the animal feed segment, Nextgreen Agrofeed Sdn Bhd is advancing groundwork for its 10,000-METRIC TON annual capacity facility, with completion now targeted for Q2 2026. This initiative broadens the Group's agro-industrial portfolio and is expected to contribute positively upon commencement of operations.

The Group's biomass division, driven by GTC Biomass Berhad (65%-owned), is progressing the development of a nationwide network of 20 Collection and Processing Centres (CPCs) for palm biomass. The first CPC is underway at the GTP, with additional sites identified in Gua Musang (Kelantan), Segamat (Johor) and Sandakan (Sabah). This network will underpin the Group's long-term raw material security and support downstream commercial activities.

In parallel, the Group is actively reviewing and structuring available land within the GTP to unlock long-term value. Several subdivided plots have been earmarked for joint-venture collaborations and strategic partnerships under Phase 2B (300,000-METRIC TON annual production), which are expected to attract new investments, enhance tenancy growth and further strengthen the overall GTP ecosystem.

Recent commercial developments have also strengthened the Group's outlook. On 13 November 2025, the Group, through NGF, entered into three strategic agreements aimed at expanding fertiliser applications across domestic and international markets. These agreements represent an important milestone in broadening the Group's commercial footprint and are expected to contribute positively to financial performance moving forward.

Looking ahead, the Group's prospects remain favorable, supported by the commercialisation of new facilities, execution of strategic partnerships, expansion across agro-industrial segments, and Malaysia's broader shift towards sustainability and the circular economy. Collectively, these initiatives will reinforce the Group's position as a leading player in green manufacturing, anchored by the continued development of its flagship Green Technology Park, while delivering sustainable earnings and long-term shareholder value.